WeBack

On the potential resurgence of WeWork--including an interview with Eliot Brown, co-author of The Cult of We.

Together with Rhone:

Your one stop coat.

The Car Coat is made for those on the move with a water resistant shell and plenty of pockets.

The pant that takes you places.

Our Tech Chino pant is a comfortable take on the classic chino.

WeBack:

The story of WeWork is a fascinating one. I’ve been infatuated with the company (and its eventual meltdown) since late 2018 and early 2019 when I started seeing many of them popping up in local urban areas. Working in a cube farm for many years, the thought of working at a fun, chic, and collaborative co-working space among other young professionals sounded enticing. However, I never took the bait, and most likely never will in this new era of remote working.

Of course, I would be remiss if I didn’t use this opportunity of discussing WeWork to rehash one of my favorite threads of all time—which, by the way, is still being updated after major company news and events occur. I guess you could say it has turned into my own personal WeWork journal.

Earlier this year, Hulu was promoting a new documentary on WeWork. Naturally, they sent me a unicorn piñata that I let the kids destroy in the garage. It was filled with candy coins and other trinkets.

The WeWork documentary gave a brief history of the saga of Adam Neumann and his startup company. However, the documentary really only scratched the surface of this troubled company with a colorful founder.

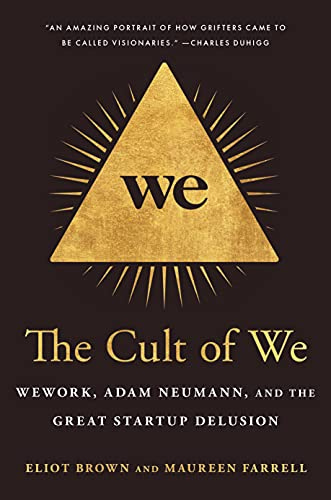

Luckily, I had known for a while that Eliot Brown and Maureen Farrell were working on a new book covering WeWork and Adam Neumann called The Cult of We. Eliot sent me an advanced copy and I was hooked after the first chapter. They did some really great reporting and some of the stories were even wilder than I had anticipated. I’d highly recommend picking up a copy.

After watching the documentary and reading their book, I wanted to ask Eliot a few follow up questions (virtually).

You had been covering WeWork for a while, when did you start noticing red flags during your reporting and what or who influenced you and Maureen to write the book?

I first came across WeWork in 2013 and met Adam at his office; one telling portent was how in our meeting, he insisted that I shouldn't be the one covering WeWork because it wasn’t a real estate company (I was a real estate reporter at the time). Instead, they were very bent on portraying themselves as a tech company, or a community company—or really anything but the business they were actually in. It later became clear to me this was because they had a tech valuation and wanted to continue raising money at software-like valuations, so there was always this dramatic chasm between the reality of their business and their appearance/valuation. Fast forward to 2019 and a whole bunch of other red flags had arisen related to Adam’s megalomania: he took out hundreds of millions of dollars in stock and loans, he bought a wave pool company and started an elementary school, he leased properties to the company; he lied to us about how much stock he’d sold. Taken with the incredibly frothy and unstable valuation ($47B!), those issues were mounting just as the company was readying to IPO, so I knew there would be some sort of book to be done. Then everything imploded dramatically in September 2019 and we struck a deal with our editor at Crown, Paul Whitlatch.

How were you able to get so much information about Masa Son?

Maureen did a lot of that reporting, and it was a mix of talking to people who used to work with him, people who still work with him and some pretty detailed reporting on his history from a biography published in Japan. He’s this super fascinating figure who is more comfortable with risk and throwing billions around than most anyone else I’m aware of on the planet. So, we thought it’d be important for the book to make clear that the rise and fall of WeWork wasn’t just the story of a financial system that enables messianic founders with lofty-but-hollow visions, but also the chance collision of two particularly combustible personalities who use the word “crazy” a lot. Some of the particularly fun stuff from negotiations—Masa sending a picture of Yoda in the midst of what would have been the world’s largest startup acquisition—was from some of the many folks involved in those discussions.

WeWork’s initial plans to go public were scrapped before the pandemic began. Obviously the pandemic has completely disrupted the work/life balance around the world. How do you envision WeWork succeeding in this new work landscape?

It’s a very good question. I think no one really knows what the future of corporate demand for office space is going to be in the endemic stage of the pandemic—now that we know the pandemic will never “end” as we once thought it would. What WeWork is now (and always really was) is a flexible provider of office leases on a shorter term than a standard landlord. If companies are uncertain about what the future will be like but still want some office space, it could theoretically be a good fit. Then again WeWork signed a lot of long-teases with landlords when market rents were higher so their costs aren’t exactly low.

WeWork just announced recently, if approved, they are planning to go public via SPAC. Has their business model changed enough to excite investors the 2nd time around?

Certainly their marketing has changed, so we no longer see them saying their mission is to “elevate the world’s consciousness,” and they’ve done a ton of cost cutting. In terms of the basic business model, it’s largely the same lease arbitrage (sans surf pools and elementary school) but without the unsustainable growth. Long-term, they say they want to do more management deals, which means WeWork wouldn’t take on the risk of a lease—they’d be paid to operate a space like Marriott is paid to run some landlord’s hotel.

How do you think their public debut will be viewed or welcomed by investors?

Everything works at some valuation! It’s hard to really say—the uncertainty over the future of the office isn’t ideal for them. Perhaps there will be more clarity about office demand once people’s kids are vaccinated and (vaccinated) parents have few health reasons to say we shouldn’t return.

Which active CEO do you think most closely resembles Adam Neumann?

One WeWork investor once told me Adam was a lot like Elon Musk. There’s tons of differences (Elon is very brilliant and makes rockets that land themselves), but there are also a lot of similarities in the ability to get funders/investors to base their view of the company on a distant future vision rather than the reality of today. And obviously Tesla's $775B valuation is nothing like any mature car company, energy company (or combination thereof).

What was your favorite story/part from the book?

Too many! A few telling anecdotes: Adam’s wife Rebekah was so concerned with electromagnetism from a 5G antenna across from their personal residence that Adam had the CFO (in the year of the IPO!) work on trying to lobby the phone companies to remove the antenna. The CFO then handed off to their top political operative. Another is Adam’s meeting with Mohammed Bin Salman (not that many months after Adam wanted to reject his money) in which he told MBS that the two of them—and Jared Kushner—would remake the Middle East (at least this is how Adam relayed it to others). And at the WeLive model unit before it was built, we have a scene of how employees had to sit there listening to Notorious B.I.G.’s “Juicy” on repeat for an hour because a chronically late Adam had investors in tow and thought they should hear that song blaring as soon as they come into the room.

Are you still covering WeWork?

No! Years of articles and a book is plenty. These days I mostly focus on startups and SPACs and companies with little or no revenue but valuations in the billions.

Do you have plans for another book covering another startup company?

No time soon! Book writing was fun but also exhausting, and I miss the pace of newspaper journalism.

We could only be a few weeks away from being able to buy or sell WeWork stock in the public markets.

As reported on by The Real Deal: To go public, WeWork will merge with BowX Acquisition Corp. The special purpose acquisition company was formed by the venture fund Bow Capital’s management team, including Vivek Ranadivé and Murray Rode. BowX stockholders will meet Oct. 19 to approve the merger.

If they do, the deal would close on Oct. 21 and the combined entity would trade on the New York Stock Exchange under the symbol “WE.”

The deal is valued at $9 billion and will provide WeWork with $1.3 billion in cash. The company said it will use the money to fund future growth plans. The planned merger already has the approval of WeWork and BowX’s boards of directors.

So what are we thinking? Buy or sell? I know my answer.

Performance Update:

Now let’s see how the People’s Portfolio did this week…

The overall markets took a pretty big hit this week, closing out September with decent sized losses but overall gains for the quarter.

As reported by the WSJ: After a long stretch of gains for the U.S. stock market this year, September was the month when percolating investor anxiety finally came to a head, forcing all three major indexes lower. The S&P 500 tumbled 4.8% in September, its largest monthly decline since March 2020, when the coronavirus pandemic spurred a selloff. The Dow Jones Industrial Average slid 4.3% for September, while the Nasdaq fell 5.3%.

Despite the slump, the S&P 500 managed to eke out a 0.2% gain for the quarter to notch its sixth consecutive quarter of gains. The Nasdaq and Dow, meanwhile, ended the period lower, marking their first quarterly losses since the first three months of 2020.

On Friday, we voted Exxon Mobil (XOM) to remain in the portfolio for another 10 weeks. XOM had a big week on the heels of oil hitting $75/barrel for the first time since 2018.

Amazon (AMZN) is on the chopping block next week for the 1st time. We’re currently holding onto a -1.30% unrealized loss over the past 9 weeks with this week’s decline of -4.15% bringing it back into the red for the period. Once big names like this get into the portfolio they are hard to remove. I don’t expect this one to get voted out.

Keep an eye out for the new Twitter poll every Friday. Follow along in real-time with nearly 300,000 others on Public.

Portfolio News Highlights:

The biggest stories affecting our portfolio this week:

Coinbase scores first 'Buy' rating as stock sags, but here's why the future may look brighter (Yahoo)

Airbnb Stock: Is It A Buy? Here's What Fundamentals, ABNB Stock Chart Action Say (IBD)

Target jump-starting the holiday season with deals and price matching starting Oct. 10 (Yahoo)

Square Partners with TikTok to Tap into New Market (Barron’s)

What Else We’re Reading:

Blogs/Articles:

Market Makers Lose at Their Own Game - Joe Saluzzi (Themis)

Let Them Eat Pizza - Doomberg (Substack)

Where Are All The .400 Investors? - Philo (Substack)

Why You Should Stop Reading The News - (Farnham Street)

Books:

The Secret History of Food: Strange but True Stories About the Origins of Everything We Eat - Matt Siegel

Need new reading material? Visit my Amazon page for my most purchased book recommendations.